There’s a new economic catchphrase making its rounds in pundit circles around the world: “Likonomics,” or the economic policies of China’s new premier, Li Keqiang. To the casual observer, Likonomics might seem somewhat like Abenomics in reverse, as its goal is to recalibrate an overheating economy rather than kick-start an economy that has languished for a decade. Nevertheless, the path faced by this new Chinese administration and its Likonomics will be long and winding, particularly because of the unique political challenges faced by the CCP.

Likonomics loosely refers to a group of policies meant to transition the Chinese economy from its current export-oriented growth to a more sustainable model based on domestic consumption. In effect, this means promoting higher wages, lower savings rates, and easy access to credit for consumers and small businesses.

The opening volley of Likonomics seems to be an attempt to de-leverage some of the growing debts held by local governments and State-owned enterprises (SOEs). Last week, the central government announced a country-wide audit of such debts, and many believe the final tally will be much higher than the previous result of $1.8 trillion due to high levels of post-2008 stimulus lending and the popularity of “non-traditional sources of credit” (read: shadow banking). Once the true extent of these debts are known, the central government will be better placed to determine where de-leveraging can actually occur and where public money has been irretrievably blown on inert monuments to state capitalism such as government buildings and manufacturing overcapacity. Ideally, the results of the audit will also produce guidelines to avoid future wasteful spending by local authorities.

The audit will likely reveal a national debt level of anywhere between 40-60% of China’s GDP. While this is a troubling figure insofar that Chinese debt has grown very quickly since 2008, a crippling debt crisis isn’t in the cards for even the most negative of audit outcomes, as China is insulated by its massive foreign reserves ($3.5 tn), high domestic savings rate, and low external debt (7.2% of GDP).

But this doesn’t mean that bloated debt and Likonomics won’t come to hurt China’s economic growth over the short term. China recorded second-quarter growth of 7.5% this year, marking its second consecutive decline, and several banks and rating agencies have predicted more drops to come. Of these, Barclays offered one of the most negative outlooks. The bank published a report recently suggesting that the Chinese economy might experience quarterly dips to as low as 3% GDP growth.

Against this growing chorus of gloomy projections, Premier Li has maintained that his administration is adopting 7% as its red line for economic growth.

And herein lies the unique challenge faced by the CCP. The social contract that has come to characterize post-Mao CCP rule, that of economic growth in exchange for a monopoly on political power, is inevitably going to be tested if Likonomics is for real and the current Chinese administration is serious about transitioning to a more market-based economy. Questions like “Who benefits, who loses?” and “How much of the present should be sacrificed for the future?” are, if not completely resolved, at least arbitrated by the democratic process. In the absence of this kind of political legitimacy, the CCP is forced to walk a very fine line between reform and ruin.

One salient example of this line will be how the government deals with SOEs. As Gwynn Guilford points out in her article on the viability of Likonomics, the rate of return for SOEs has diverged from that of private companies, dropping considerably since 2008. Take the fact that SOEs account for over 40% of Chinese economic activity and you have a problem. But when political factors are taken into account, such as the large number of migrant workers that SOEs employ and the entrenched Party factions that represent their interests, the problem expands considerably. Now it is a structural hurdle, one of many ‘social stability’ landmines that litter the current administration’s path forward. Consequently, the government might be forced to ease up on SOE reform, perpetuating overcapacity and a drag on the Chinese banking system that stymies consumer credit, and by extension the dream of a domestic consumption-based economy.

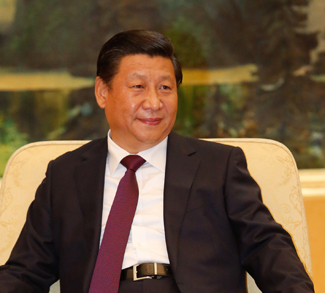

This is just one example of the dissonance between China’s economics and politics, and it serves to illustrate an important point: Likonomics will have to proceed cautiously, and we shouldn’t be surprised if it is temporarily reigned in in the likely event of a shock. But that having been said, the Xi Jinping administration has demonstrated a considerable commitment to market reform in the early days of its rule, and even with the expected short-term hits to China’s economic growth, we should expect the overall goal of a liberalized, consumption-based economy to remain fixed.