Russia’s dominance of Europe’s natural gas market, widely seen as threatening European energy security, is likely to be increasingly challenged as new suppliers establish a foothold in the region.

While Russia remains the European Union’s largest gas provider, Liquefied Natural Gas (LNG) from the US and other sources, such as Qatar, coupled with the emergence of Azerbaijan as a major gas supplier, is creating real competition, reducing member states’ dependence on Russia.

The US has long sought to encourage the EU to diversify its supplies of gas, worried that Russian energy supremacy allows it to wield political and economic influence over the bloc. Russia counters that these concerns betray a desire to increase its stake in the world’s second-biggest single gas market after the US. The Kremlin has also accused Washington of using energy as a political weapon. Igor Sechin, the CEO of Russia’s state-controlled oil producer Rosneft, claimed last June that the US wanted to curb cheap Russian gas exports to Europe to undermine Russia and slow the European economy.

US sanctions Nord Stream 2

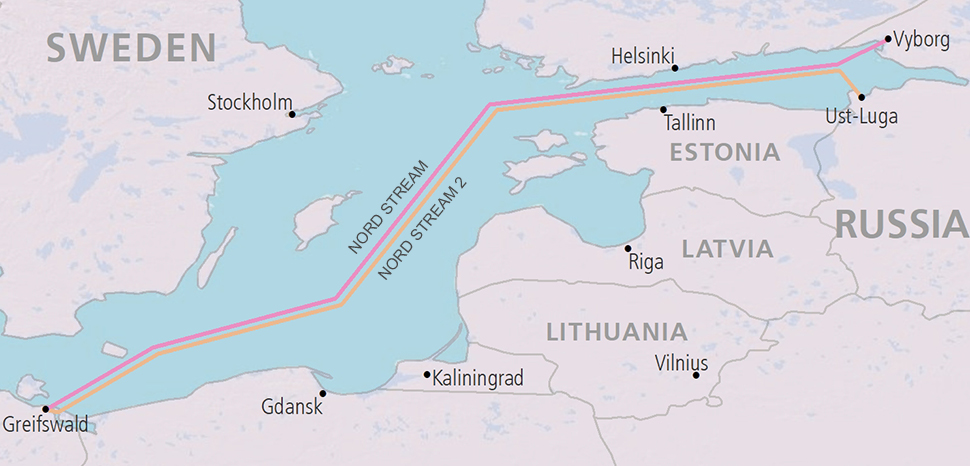

The escalation in tension culminated late last year, when America sanctioned the almost-complete $11 billion, 1200 km Nord Stream 2 pipeline, set to deliver Russian gas to Germany and other European markets. The US action has forced Russia into using one of its own pipe-laying vessels, which is likely to set back the pipeline launch to the end of this year or early 2021, with a coronavirus-related reduction in demand possibly adding to delays.

Several years ago Russia cancelled the South Stream pipeline, which would have supplied Southeast and Central Europe via the Black Sea, after the EU deemed that it breached the bloc’s competition rules. The cancellation came amid strained relations with Europe following Moscow’s annexation of Crimea and support for separatists in the east of the country.

Nord Stream 2, which will double the existing Nord Stream pipeline’s capacity, has raised concerns in a number of eastern European countries that it will undermine their energy security. Ukraine, the main corridor for Russian gas exports into Europe, is particularly vulnerable as Russia will be much less reliant on it. That could squeeze Kiev’s substantial transit fees and possibly leave the country exposed to politically-motivated cuts in supplies to its domestic market. Moscow’s efforts to bypass Ukraine went a stage further in January with the launch of the $7.8 billion 930 km TurkStream pipeline, which follows roughly the same route as the jettisoned South Stream project.

But while much attention has focused on Russia’s designs on the European gas market and use of supply to exert influence, its dominance might be under threat as other sources of gas increase competition in the bloc.

Shale gas production has turned America into a major LNG exporter, the third-largest in the world, with supplies to the EU surging last year, surpassing exports to Asia. That flow, however, is showing signs of a decline due to falling demand resulting from the pandemic, with reports that a number of US cargoes scheduled for June may be cancelled.

The Trump administration has branded Europe-bound shipments “freedom gas”, reflecting its view that they are helping to undermine Russia’s dominant position in the European market. It is perhaps too early to tell how US supplies will be affected by the pandemic in the long term – but, overall, LNG’s contribution to EU energy now seems well established. The bloc received record deliveries last year, 75 per cent higher than 2018, representing 27 per cent of all natural gas imports.

Azeri pipeline close to completion

At the same time, Azerbaijan is emerging as a major gas exporter to Europe. The EU-backed Trans Adriatic Pipeline (TAP), the final stretch of a network of pipelines linking Italy to the Caucasian republic’s Caspian Sea fields, is expected to be ready later this year – though the economic impact of the coronavirus might delay plans. TAP is the European leg of the $40 billion, 3,500 km Southern Gas Corridor (SGC), its longest section, the Trans-Anatolian Natural Gas Pipeline (TANAP), launched in 2018, already delivering Azeri gas to Turkey.

Azeri gas and LNG supplies have already helped the region to reduce its dependence on Russia. In the first half of 2019, Russian gas exports to Turkey and eight other Southeast European countries fell by more than a quarter, according to Reuters.

Some have suggested that EU rules allowing producers to use European pipelines other their own could allow Russia to utilise TAP, reducing the amount of gas Azerbaijan can supply. But Vitaly Baylarbayov, deputy vice-president of SOCAR, the State Oil Company of Azerbaijan, told Euractiv that possible Russian use of the pipeline will not affect delivery plans.

Baylarbayov pointed out that the capacity of SGC can be expanded, and that in future it may be used to carry Central Asian gas to Europe. Moreover, the Baku leadership is confident that Azeri supplies, currently sourced from Shah Deniz field, will be supplemented by other domestic offshore reserves. Indeed, Europe is reported to be considering expanding its purchases from Azerbaijan on the back of possible new finds in the Caspian.

But Europe is not in a position to start cutting back on Russian supplies just yet. EU officials helped to broker a December deal between Russia and Ukraine under which gas from Russia would continue to be pumped via Ukraine to Europe for the next five years. While the agreement is a welcome sign of cooperation, it could be put to the test once Moscow’s options for reducing its reliance, or even bypassing, its western neighbour are fully operational.

Yigal Chazan is the head of content at Alaco, a London-based business intelligence consultancy.