Background

The global energy landscape is shifting towards renewables, and Canada’s carbon-intensive oil sands risk being left in the dust. This is the conclusion of a report by Policy Horizons, an internal government think tank whose job it is to inform government policy in Canada. The report, entitled ‘Canada in a Changing Global Energy Landscape,’ was recently obtained by the Canadian Broadcast Corporation following a freedom of information request.

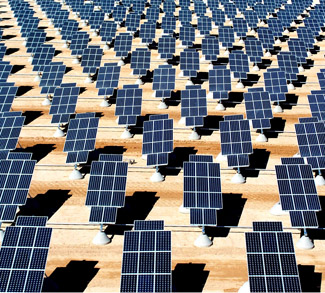

The study argues that the medium-term trend in global energy markets is that of shift away from fossil fuels as renewables, particular wind and solar, become more competitive. The two driving forces behind the shift are decreasing capital costs of renewables – which allows them to compete more directly with fossil fuels – and new breakthroughs in storage technology, which ensure stable electricity generation at any time and in any weather. These factors, when combined with the societal benefits of less pollution and a reduced carbon footprint, make the case for renewables’ continuing ascendance in the global energy portfolio.

The report also suggests that it won’t be oil or gas deposits determining the geopolitical winners and losers in the decades to come – it will be access to renewables technology, and the minerals required to manufacture the power generation and storage equipment.

Other key findings from the report:

- Electricity is expected to be the world’s fastest-growing form of final energy.

- Many renewables can already produce electricity cheaper than fossil fuels, and production costs on renewables such as photovoltaic are expected to drop below fossil fuel levels within the next few years.

- Costs are declining faster than originally forecasted in the field of storage technology.

- Transportation could electrify faster than expected as electrical cars become more competitive.

- As global oil production increases and buyers decrease due to the proliferation of renewables, oil prices could plummet as producers compete amongst one another for remaining market share.

Impact

A hard shift away from fossil fuels in global energy markets would have a profound geopolitical impact on oil producers. The post-2014 dip in energy prices has highlighted just how important energy exports are for high-cost producers like Canada, Russia, Brazil, and Nigeria; even low-cost producers such as Saudi Arabia and Iraq have been reeling in the low-cost environment.

This is the surface impact of a shift away from fossil fuels: the lost jobs, the wasted capital in underperforming pipeline investments, and the political and even security significance of overextended government finances. These are just a few of the immediate geopolitical consequences facing those in the ‘losers’ column of a new global energy landscape based on renewables.

Yet there is also a ‘winners’ column with its own geopolitical ramifications. Fossil fuels are strategic commodities because they have remained a key driver of economic development through the twentieth century. If this longstanding status were to fade, various countries would suddenly be able to ensure their own energy supply without worrying about finding suppliers and securing these supply lines over vast tracts of land or sea. The strategic appeal for net importers lacking in oil and/or natural gas reserves is obvious: with the right technology and the right price, an uncontrollable ‘x factor’ of foreign imports could be replaced with a controllable one in a stable flow of domestic electricity production.

Technology and strategic minerals determine the gatekeepers in the global energy landscape envisioned by the Policy Horizons report – not pipeline placement and fossil fuel reserves. Should the scenario envisioned by the report be eventually realized, it would amount to a geopolitical reshuffling that reverberates in every corner of international society.

Some of the winners and losers in such a world are as follows: