Summary

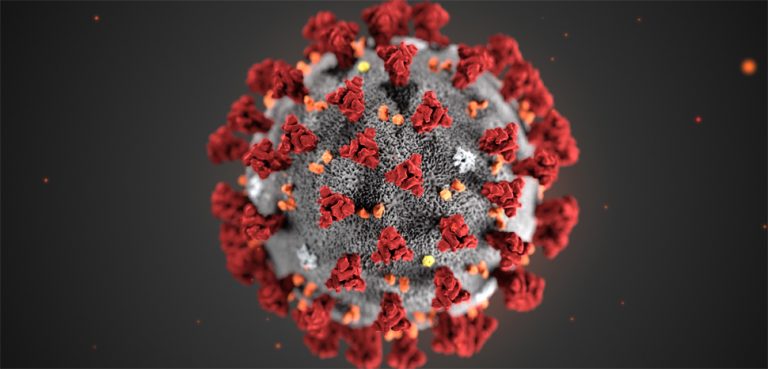

To set the scene from earlier this week: US equity markets are in freefall, President Trump is tweeting furiously at Jerome Powell, and concerns of an uncontrollable COVID-19 pandemic are growing. Then, completely out-of-the-blue, the US Federal Reserve announces an off-schedule interest rate cut of 50 basis points. And thus the markets were appeased; a central bank had come to the rescue, as has become the established pattern since the financial collapse of 2009. Yet, in a troubling sign for policymakers, the resulting reprieve from market volatility was exceedingly brief. This suggests that either the unconventional monetary policy toolbox is running out of tools or that COVID-19 represents a far more serious threat than any cyclical downturn.

In truth it could be both.