FORECAST

A bailed out Greece and Irish Republic may have temporarily calmed the beast of rampant bond speculation, but deep fiscal rot in both Portugal and Spain has the potential to kick off a new round of European debt déjà vuWhat we are seeing in Europe is a crisis with no easy solution, and one that will likely continue to unfold over the next few years. After a German-brokered bailout temporarily righted the fiscal ship in Athens (to the tune of 110 billion euros) and the Irish Republic (85 billion euros), one could easily make the mistake of taking a recovered euro to mean that the European debt crisis was over. Unfortunately, as the current fiscal situation in Portugal and Spain clearly illustrates, it’s far from over.

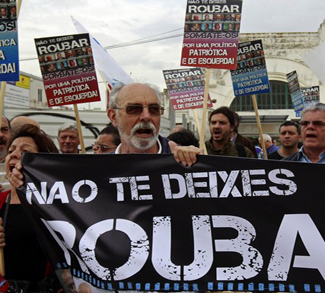

In Spain, bond markets have recently been hit by jitters over Greek debt restructuring, causing ten-year yields to rise by 18 basis points. Elsewhere on the Iberian Peninsula, the Portuguese government has itself just entered into talks over a possible European bailout. It’s expected to just be a matter of time until such a bailout is approved, and the final amount is rumoured to be somewhere in the vicinity of 80 billion euros. It should be noted that there is substantial grassroots opposition against an EU-administered bailout in Portugal, as evidenced by the fall of Jose Socrates government over a proposed austerity package.

Market uncertainty doesn’t end at the future of Spain and Portugal. Greece is once again on the radar as suggestions of a Greek debt restructuring plan have raised the old spectre of default. A Greek restructuring could potentially send shockwaves out across the euro zone, as Greek government debt is widely held by not just Greek banks, but major French and German ones as well.

Thus, the now-familiar fear of sovereign debt within the euro zone is once again rippling through the global economy. But, this time there is even more reason to fear that there won’t be enough political will within EU governments to deal with the crisis. Populations throughout the EU are showing signs of bailout exhaustion. Even Germany is not immune, and it seems that Germans are increasingly questioning whether or not there is an end in sight to Berlin having to foot the bill for economic improprieties across the euro zone. Endless German support for bailouts should not be assumed, especially given the surprising results of a inframest dimap survey published three months ago that claims 57% of Germans believe they would have been better off with the mark.

Perhaps the clearest indication of political turmoil moving forward is recent wins for the euro-skeptic True Finns party the Finnish national election. The True Finns platform is to reject bailout plans for Portugal on principle alone, and Finland’s parliament can vote on whether or not to pass any new bailout. That the True Finns victory might result in legal roadblocks isn’t terribly worrisome in the grand scheme of things. What is shocking however is just how far Finland has moved away from its conventionally pro-Europe orientation. This stands as a sobering indication of political entropy moving forward; a process that could quite easily be intensified by the appearance of a new sovereign debt shock in the euro zone.