The Bank of International Settlements (BIS) has sounded the alarm about excessive debt in the Chinese financial system. According to the BIS – an international banking watchdog – China’s credit-to-GDP gap has now reached 30.1. The next highest country on the list is Canada with 12.1.

A rating above 10 indicates a banking crisis within the next three years.

The problem stems from the fact that Beijing has long relied on credit expansion to fuel its economic growth. This credit has been used to expand SOEs, build new infrastructure and government buildings, engage in property speculation, and, more recently, simply to pay down preexisting loans. According to The Economist, roughly two-fifths of all new debt goes directly toward paying interest from previous loans. Unsurprisingly, it’s getting more and more difficult to convert credit into productive GDP value.

The speed of China’s debt accumulation was singled out by the BIS as particularly worrisome. China’s total debt-to-GDP ratio grew to 255% this year, up from 147% in 2008.

Dealing with debt

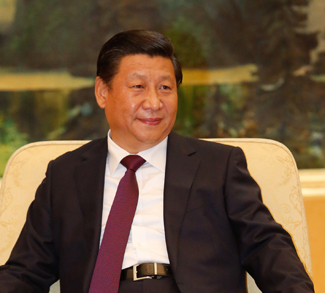

The debt problem is obvious, but dealing with it is a question of political will. The issuance of new debt has ensured continued growth under difficult global circumstances; turning off the taps will slow the economic engine, which is a sensitive issue for the Party. The debate is surely playing out behind the closed doors of the Xi administration, as is the norm for Chinese politics. We caught a glimpse of it back in May, when an anonymous letter from a top official was published in People’s Daily. The letter took policymakers to task for allowing debt to balloon, warning that debt-fueled growth could not go on forever.