Politics

Thai Political Crisis Redux

A full blown crisis rang in the New Year in Thailand, where mass mobilizations and protests have dominated recent news headlines. Led by Suthep Thaugsuban of the opposition Democratic Party, the middle and urban working classes have risen up against the government of Yingluck Shinawatra, whom they regard as corrupt. The protestors are demanding that Yingluck, sister of exiled former prime minister Thaksin Shinawatra, remove herself from power and allow a process of governmental and electoral reform to take place before any new elections are held. Meanwhile, the mostly rural “red shirt” supporters of Yingluck oppose the protestors, insisting that the democratic status quo be maintained and grievances against the government be expressed in voting booths this February.

Though the protestors insist that their intentions are peaceful, the conflict is steadily escalating, with the government recently warning of large increases in the sale and theft of weapons and ammunition. This yet unsubstantiated allegation might eventually serve as a pretense to declare a state of emergency, which would allow the government to impose stricter countermeasures against the protestors.

Such a move would have far-reaching consequences, as the state of Thai democracy is far from secure. A long history of military intervention in Thai politics suggests that if tensions continue to intensify at the present rate, the army may take matters into its own hands and stage a coup in the name of maintaining order.

Elections in Southeast Asia

2014 will be an eventful year for democracy in Southeast Asia. Elections are scheduled for Thailand and Indonesia, and we can also expect preparations and posturing in the lead up to Myanmar’s general elections in 2015.

The Indonesian election is expected to produce a blowout, with charismatic and populist politician Joko “Jokowi” Widodo being elected president by a wide margin. Jokowi is a young and non-traditional figure, whose authentic and laid-back public image – as well as his competent tenure as governor of Jakarta – resonates with many voters, particularly the youth. 2014 will almost certainly see Jokowi replace political fixture Megawati Sukarnoputri as head of the PDI-P party. Megawati, the far more experienced politician and current leader of the official opposition, has yet to carve out a meaningful support base in the wider electorate. In the upcoming year, there is a strong chance that she will reluctantly step aside for Jokowi, whose popularity could easily propel the PDI-P back into power for the first time in many years.

Elections in Thailand are far less assured, as they are currently being boycotted by the main political opposition in the country. Mass demonstrations calling for the government to step down before February elections have all but shut down the country’s political apparatus, and whatever the process is that eventually takes place – it’s unlikely to go smoothly.

Whether in actual practice or merely in rhetoric, the theme of ending corruption will figure prominently in the region in 2014. With elections on the horizon in several ASEAN states, and against the backdrop of ongoing economic liberalization, Southeast Asian politicians will use anti-corruption initiatives to convince voters and investors alike that decision-making in the region is becoming more transparent, efficient, and accountable.

Myanmar as ASEAN Chair

2014 projects to be a landmark year for Myanmar. The former regional pariah will be taking its turn as the ASEAN chair. Eager to prove their commitment to nascent democratic reforms and a newly liberalized economy, Burmese leaders will relish the opportunity to present themselves as regionally-engaged team players, and thus will assume the ASEAN position with enthusiasm. This high profile role may in turn prompt the government to issue condemnations, or at least decrease its implicit support, of ongoing violence against Muslims in Myanmar.

Military

Japan to Warm up to ASEAN?

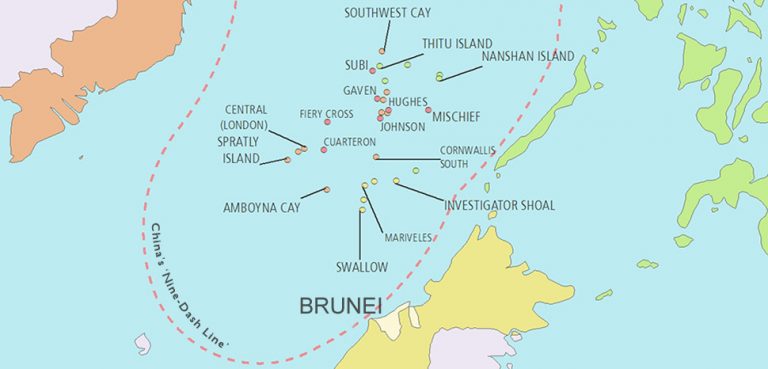

Ongoing territorial disputes between various ASEAN states and China risk flaring up in 2014. Following China’s sudden declaration in late 2013 of an air defence zone over the disputed waters off its eastern coast, Southeast Asian leaders are increasingly wary of a similar declaration covering the waters Beijing claims in the South China Sea – most of which is subject to overlapping claims from several different states.

Southeast Asian countries such as Vietnam and Indonesia have embarked on a policy of expanding their naval power through the procurement of submarines; doubtlessly with an eye on asserting direct control over their claims. In addition, ASEAN as a bloc is moving towards closer economic and strategic cooperation with Japan, which has its own major territorial disputes with China. This scenario paints a picture of classic military balancing against Beijing – a theme that is likely to be prominent throughout 2014.

Economic

Regional Growth Prospects

The New Year should see strong growth in many Southeast Asian economies. The OECD is predicting GDP growth that is more or less on par with pre-financial crisis levels. Upward trends will be strongest in the most emergent economies as they make major developmental strides, while the service-based and advanced economies such as Singapore will see more moderate growth.

Southeast Asian Currency Woes

The value of Southeast Asian currencies is expected to drop against the US dollar in the first half of 2014, with a possible stabilization and modest rebound taking hold towards the end of the year. Major sell-offs in several emerging economy currencies began over the summer when the US Federal Reserve obliquely signalled an end to its quantitative easing program. Without the downward pressure on US bond rates, and without a steady supply of low-interest rate loans, investment flows are diverting away from emerging markets and towards the comparatively safe returns offered by US markets. Whether this translates into a hard or soft landing for certain Southeast Asian currencies (Indonesia’s and Thailand’s in particular) remains to be seen, but this issue is definitely one to watch as the US taper gathers steam through 2014.