Gauging the opinions of investors can be an appealing, if ineffectual practice. Posing straightforward questions to consumers about how they find current employment opportunities or asking manufacturing firms about supplier deliveries can provide a reasonable guide to economic conditions. But surveying groups of investors for their market forecasts will typically result in answers that are liable to change in minutes. Of course, in many investor surveys there never seems to be room for a “don’t know” answer. Even so, they can be used as a useful platform for debating major market themes.

At a European alternative investment conference I was at last week more than one hundred investors of institutional, private fund and high net worth backgrounds were asked several questions on their outlook for 2013. As each investor entered the auditorium they were given a keypad to vote on several questions that appeared on a large screen. Afterwards, a variety of industry figures debated the topics and at the end of the day the audience was again asked to vote on the same questions to see if their opinions had altered. Unsurprisingly, the voting patterns changed, although the ranking of answers remained the same.

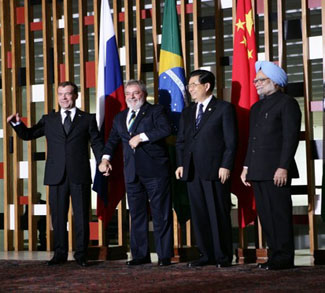

The investors were asked: What will be the dominant factor in markets this year? The available answers were: Policy Makers; US economic strength; or the strength of BRIC countries. Given experiences over the last several years Policy Makers was predictably the most popular choice for 60% of the voters [at the end of the day]. US economic strength received 33%, with the strength of BRIC countries at 7%.

It’s worth looking at the possible reasoning behind this result. The year has already seen Japan begin its implementation of an aggressive monetary easing policy and their stance has brought media-grabbing accusations of instigating a “currency war.” Yet while the Japanese yen has weakened more than 20% since its 2012 lows, its current rate is only at 2010 levels. The Bank of Japan will have a considerable amount of expansion to do if it is to bring the yen to a level that will have a truly lasting impact on its exports market. It is not the first time Japan has made efforts to weaken its currency, even if on this occasion they say their monetary policy is not a direct attempt to devalue the yen. Despite being heavily under the influence of the government, the Bank of Japan will have great difficulty in bringing the yen back to pre-2007 levels.

Japan would have been better served if it was more direct in its approach and adopted a policy similar to what Switzerland did in 2011. With the euro weakening sharply at the time, as a safe haven, the demand for the franc soared, so much so that the Swiss central bank drew a line at 1.20 versus the euro and vowed to intervene in markets to weaken their currency if this level was broached. They have been true to their word ever since. Japan’s efforts promise to be rather less straightforward.

Japanese policy has been at the forefront of attention and dominated much of the conference presentations, but it may well be action from the ECB that has the most impact on markets in 2013. With the euro now at its strongest levels versus the USD since late-2011, the ECB may consider taking action to bring their currency back below 1.30. The stronger euro will serve to make eurozone exports less competitive, prolonging recession in the region. Moreover, the diverging stances of political leaders towards ECB policy could raise tensions in the eurozone, as Germany’s strong opposition to potential inflationary pressures will add a degree of uncertainty to the prospects of monetary expansion, making it a key factor through the first half of the year.

While only a small percentage of voters at the conference expect the BRICs to be a dominant theme this year, 40% believed emerging market risk assets will be the best performing market compared to US (37%) and European (23%) markets [percentages are from the end-of-day voting]. The relative closeness of the result indicates a lack of strong conviction, highlighting the prevailing lack of medium-term market certainty. Without getting caught up in the noise of such surveys, it is interesting that investors would still have confidence in the emerging market story.

The strong growth that characterized emerging markets in 2010-11 is showing no sign of an imminent return. The largest emerging economies have experienced slowing growth over the last year and the prognosis for 2013 is not much better. Weakness in the developed world will weigh on emerging market exports. While China will have strong growth relative to the US and Europe, it is expected to be far from the pre-2012 pace and authorities have little room for further fiscal stimulus in the near-term.

A drop in Chinese demand will hurt the Brazilian economy, and a relaxation in monetary policy has left Brazil vulnerable to inflation risks. And while the Indian stock market is near record highs, the country is facing rising inflation, falling growth and potential political uncertainty following elections next year. Russia has the potential to perform well, although it too has been dealing with increased inflation and a stubbornly high dependency on oil prices leaves it with a precarious economic outlook. There may be optimism surrounding several emerging markets such as Mexico and various smaller East Asian economies, but the BRICs certainly won’t be the savior to investors that they were post-2008.

Clearly, the conference organizers’ voting experiment shouldn’t be used as an accurate measure for market sentiment. But, if nothing else, the exercise helped the conference achieve something notable; it temporarily distracted most attendees from their Blackberry.