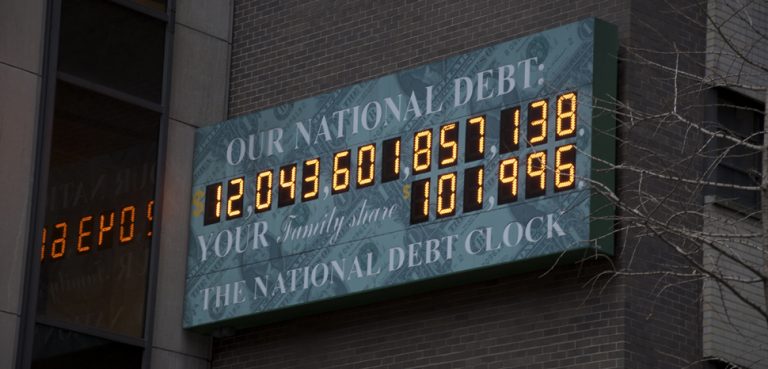

US Debt

US Federal Debt: How Much Is Too Much?

The COVID-19 pandemic has US public debt running at levels not seen since World War II. But the global economy of 2020 offers far fewer avenues of growth-driven escape.

COVID-19: Bailouts & US Debt

COVID-19 bailouts have pushed US federal spending to dangerous levels, and this with the pandemic still raging in a long list of US states.

US Debt to Spike in Wake of COVID-19

The US government debt load was already teetering on the precipice of becoming unmanageable - then COVID-19 hit.

BIS Sounds Early Alarm on US Corporate Debt

Are collateralized loan obligations brimming with toxic corporate debt just a little bit of history repeating?

Foreign Demand for US Debt Slips in October

China and Japan have been paring their holdings of US Treasuries over the past few months. Is this the start of a trend?

US Debt (November 20, 2018)

Zac and Nick discuss whether the growing pile of US federal debt is cause for concern or merely business as usual.

FLASH: IMF’s Post-2009 Financial Crisis Regulatory Report Card

The IMF’s latest report warns that the global financial system hasn’t yet fully learned the lessons of 2009.

Will Foreign Buyers Sour on US Debt?

Will foreign buyers like China and Japan step in to finance Washington’s latest deficit spending binge?

US Debt & Entitlement Reform

Entitlement reform would go a long way in balancing the US debt outlook, but getting it done won’t be easy.

US Debt: A Ticking Time Bomb?

Part one in a two-part series, this article examines the issue of ballooning US debt.